Employee Direct Deposit

Important Notice

Direct Deposit and Electronic Notification of Pay

Since 2008, all employees – faculty, staff, temporary employees and students who receive pay through Payroll Services – participate in mandatory direct deposit of pay per the University’s Payroll Direct Deposit Policy. Direct deposit provides assurance that your pay will be in your bank account as of the bank opening on pay day. Direct deposit is secure, reliable, convenient and fast, and with direct deposit there are no lost checks.

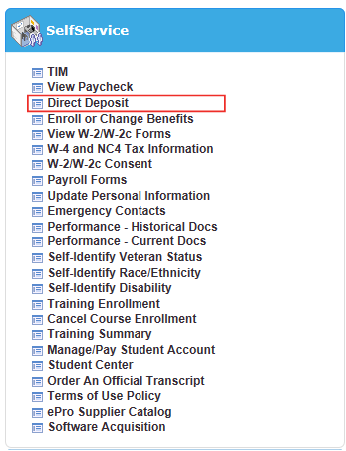

Employees enrolled in direct deposit can view details of earnings and deductions by accessing their pay notifications online using the Self-Service menu in ConnectCarolina. Online access provides a secure way to view or print your pay notifications not only for the current pay period but for past pay periods.

Employees enrolled in direct deposit can view details of earnings and deductions by accessing their pay notifications online using the Self-Service menu in ConnectCarolina. Online access provides a secure way to view or print your pay notifications not only for the current pay period but for past pay periods.

How to Enroll in Direct Deposit

Employees can enroll in direct deposit by using 2-Step Verification (Duo) and ConnectCarolina’s Self-Service menu. Use the quick reference cards below:

How to Change Direct Deposit Account Information

Employees can update their personal direct deposit account information at any time using the Self-Service menu in ConnectCarolina. This can be useful if employees change banks and have a new routing number. Employees can also divide their direct payroll deposit amount into several accounts, for example, into checking and savings accounts. Managing direct deposit accounts online uses Duo two-step verification to make sure you are who you say you are before you access Direct Deposit. Tips for using Duo are included in the trainings listed below.

Setting up multiple direct deposit accounts is more complex than making a change to a single direct deposit account. Employees should review the step-by-step instructions in the guide listed below before logging in to Self Service and carefully completing the steps.

Training

Training documents are available for enrolling and managing your direct deposit of pay accounts:

- Setting up Direct Deposit and Changing Account Information Quick Reference Card (QRC)

- Setting up Multiple Accounts for Direct Deposit Quick Reference Card (QRC)

Frequently Asked Questions

- When will employees see their direct deposit account change take effect?

- If you choose to make a change to your direct deposit accounts, you will receive an email sent to your university email account acknowledging the change. You can expect your account change to be effective within two pay periods, but depending on the timing of the account change, it may occur as soon as your next pay check.

- Do I have to take action once Self-Service Direct Deposit is available?

- If you are a current employee with an existing direct deposit account, you do not have to take action unless you want to make a change to your account. New employees will register for direct deposit using the self-service option.

- How do I split my paycheck amount?

- See the QRC for multiple accounts.

- Can I make a change to my direct deposit accounts using a paper form?

- Yes, paper direct deposit forms will continue to be accepted with identification in the Payroll Services Office at 104 Airport Drive, Suite 3600, in the Administrative Office Building. Mailed forms will not be accepted.

- How many accounts can I split my pay into?

- Self-Service Direct Deposit will support up to ten (10) checking or savings accounts.

- Can I set up my direct deposit accounts to pay my bills?

- No, the direct deposit accounts must be either checking or savings accounts.

- What is a “Balance of Net Pay” account?

- “Balance of Net Pay” is an account deposit type option. All employees will designate a “Balance of Net Pay” account. If this is your only account, it will receive all your net pay (your full paycheck amount). If you have multiple direct deposit accounts, this account will receive the remainder of your paycheck amount after you designate percents/amounts for your other accounts. This account line cannot be deleted and should be edited first when managing multiple direct deposit accounts. This account will also be the one that reimbursements are sent to, for example, for travel reimbursements. This and other terms are explained in the Setting up Multiple Accounts for Direct Deposit Quick Reference Card.

Contact Information

If you have any questions about the direct deposit of pay, please email payroll@unc.edu. If you have technical problems with direct deposit functionality, contact the Help Desk at 919-962-4357 (HELP).

Banking Services

Direct deposit of pay is made into the bank or credit union account that the employee selects. As one alternative for employees, the University has agreements with both Wells Fargo and Bank of America to provide a package of banking services for all University employees. Services include a fee-free checking account for individuals to accept direct deposit of pay as well as other banking services. The NC State Employees Credit Union also provides a fee-free account for state employees.

A Share Account is the fee-free account offered by the NC State Employees Credit Union (NCSECU) for your direct deposit of pay. Information on the NCSECU can be found

- by accessing the credit union’s website,

- by visiting a local branch office, or

- by calling one of the local branch offices.

At Work Checking is the fee-free checking account offered by Wells Fargo for your direct deposit of pay. Information on the Wells Fargo program can be found

- by accessing the bank’s website,

- by visiting their local financial center, or

- by calling 888-353-7375

MyAccess Checking® is the fee-free checking account offered by Bank of America for your direct deposit of pay. Information on the Bank of America program can be found

- by accessing the bank’s website,

- by visiting their local banking center, or

- by calling 800-782-2265.